Petty CashChange Fund Reconciliation free printable template

Show details

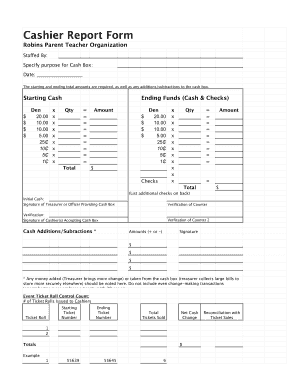

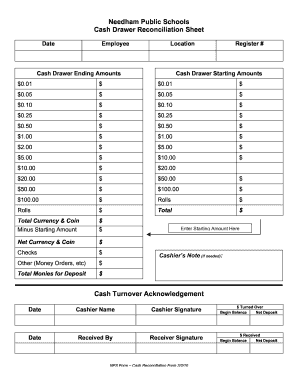

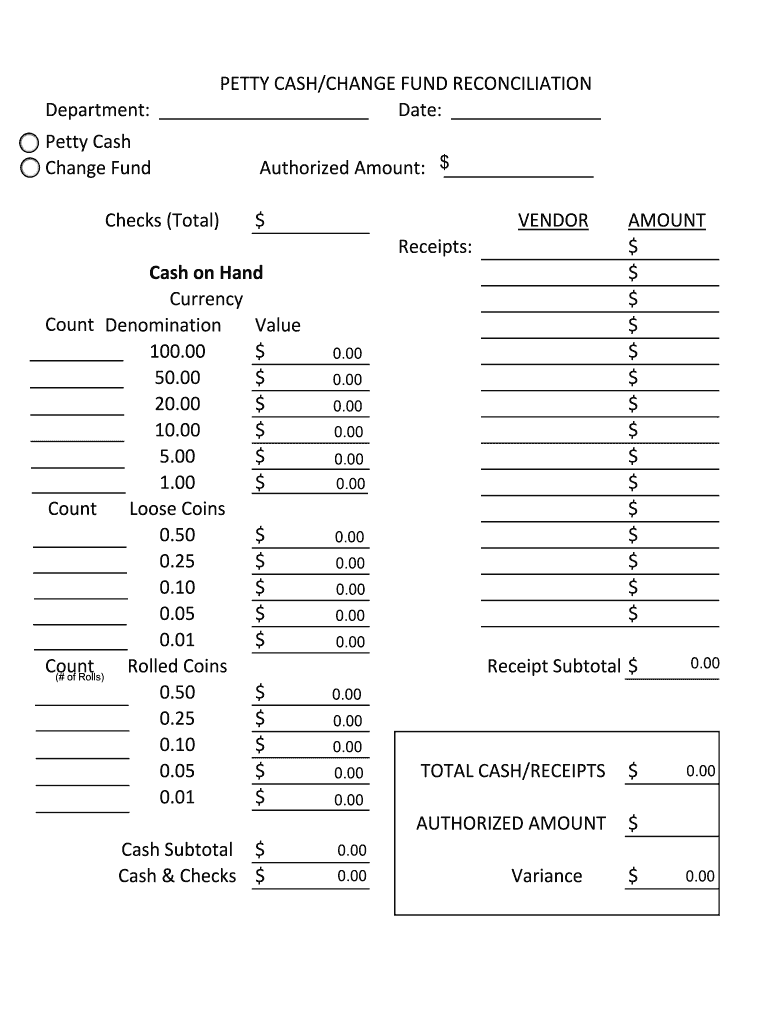

CLEAR FORM PETTY CASH/CHANGE FUND RECONCILIATION Department Date Petty Cash Change Fund Checks Total Authorized Amount VENDOR Receipts Cash on Hand Currency Count Denomination Value 100. 00 50. 00 20. 00 Count Loose Coins Rolled Coins of Rolls AMOUNT Receipt Subtotal TOTAL CASH/RECEIPTS AUTHORIZED AMOUNT Cash Subtotal Cash Checks Variance.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign petty cash reconciliation printable form

Edit your blank printable cash drawer count sheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your printable petty cash form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing printable daily cash drawer count sheet online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cash drawer count sheet form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out petty reconciliation print form

How to fill out Petty Cash/Change Fund Reconciliation

01

Collect all petty cash vouchers and receipts since the last reconciliation.

02

Count the actual cash on hand to verify the total amount.

03

Prepare a reconciliation sheet, listing all petty cash vouchers and their amounts.

04

Calculate the total of the cash on hand and the total of the vouchers.

05

Compare the cash on hand with the total of the vouchers to ensure they match.

06

If there are discrepancies, investigate and note the reasons for any differences.

07

Document any adjustments or corrections needed and update the petty cash fund if necessary.

08

Submit the reconciliation for review and approval by the appropriate authority.

Who needs Petty Cash/Change Fund Reconciliation?

01

Small business owners managing daily expenses.

02

Accountants or financial officers responsible for financial tracking.

03

Administrative staff handling petty cash disbursements.

04

Auditors checking for compliance and accuracy in financial reporting.

Fill

petty cash audit form

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my printable cash drawer count sheet pdf directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your petty cash reconciliation pdf and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I modify end of day cash register report template without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including petty cash policy. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an electronic signature for the daily cash reconciliation in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is Petty Cash/Change Fund Reconciliation?

Petty Cash/Change Fund Reconciliation is the process of verifying and balancing the amount of petty cash or change funds against the receipts and record of expenditures. This ensures that the total cash on hand matches the documentation of how that cash has been spent or used.

Who is required to file Petty Cash/Change Fund Reconciliation?

Typically, any organization or business that maintains a petty cash or change fund is required to file a reconciliation. This includes companies, governmental entities, and nonprofit organizations that handle small amounts of cash for operational purposes.

How to fill out Petty Cash/Change Fund Reconciliation?

To fill out a Petty Cash/Change Fund Reconciliation, one should list the total amount of cash on hand, the total receipts for expenditures, and calculate the difference. It is important to ensure that the cash amount plus receipts equals the total fund amount established. Any discrepancies should be noted and investigated.

What is the purpose of Petty Cash/Change Fund Reconciliation?

The purpose of Petty Cash/Change Fund Reconciliation is to maintain accurate financial records, ensure accountability, prevent theft or mismanagement of funds, and ensure that the funds are being used appropriately for their intended purpose.

What information must be reported on Petty Cash/Change Fund Reconciliation?

The information that must be reported includes the total cash on hand, the total receipts supporting expenditures, the initial balance of the petty cash/change fund, any additional funds added or returned, and the final reconciled amount along with any discrepancies found.

Fill out your Petty CashChange Fund Reconciliation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Printable Petty Cash Sheet is not the form you're looking for?Search for another form here.

Keywords relevant to printable petty cash log

Related to petty cash change fund reconciliation

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.